Do You Pay Property Tax On Va Loans . Some states may only give exemptions to veterans who are 100% permanently disabled. Property tax exemptions for veterans. Lenders may require downpayments for some borrowers using the va home loan guaranty, but va does not. The disabled veterans property tax exemption can help reduce the amount a disabled veteran pays per year in taxes. If property taxes are unpaid the local government can foreclose the property — even if the monthly. Due to the variances in property taxes from location to location, it's important to send. Tax deductions for va home loans. There are a few different tax deductions that va borrowers can take advantage of. Property taxes can vary greatly by state, county or region.

from www.buyhomesincharleston.com

The disabled veterans property tax exemption can help reduce the amount a disabled veteran pays per year in taxes. Property tax exemptions for veterans. Lenders may require downpayments for some borrowers using the va home loan guaranty, but va does not. If property taxes are unpaid the local government can foreclose the property — even if the monthly. Some states may only give exemptions to veterans who are 100% permanently disabled. Due to the variances in property taxes from location to location, it's important to send. There are a few different tax deductions that va borrowers can take advantage of. Tax deductions for va home loans. Property taxes can vary greatly by state, county or region.

How Property Taxes Can Impact Your Mortgage Payment

Do You Pay Property Tax On Va Loans If property taxes are unpaid the local government can foreclose the property — even if the monthly. Due to the variances in property taxes from location to location, it's important to send. Tax deductions for va home loans. If property taxes are unpaid the local government can foreclose the property — even if the monthly. The disabled veterans property tax exemption can help reduce the amount a disabled veteran pays per year in taxes. Property tax exemptions for veterans. There are a few different tax deductions that va borrowers can take advantage of. Some states may only give exemptions to veterans who are 100% permanently disabled. Property taxes can vary greatly by state, county or region. Lenders may require downpayments for some borrowers using the va home loan guaranty, but va does not.

From va-kreeg.blogspot.com

√ Does Veterans Pay Property Taxes Va Kreeg Do You Pay Property Tax On Va Loans Tax deductions for va home loans. Property tax exemptions for veterans. Lenders may require downpayments for some borrowers using the va home loan guaranty, but va does not. If property taxes are unpaid the local government can foreclose the property — even if the monthly. Due to the variances in property taxes from location to location, it's important to send.. Do You Pay Property Tax On Va Loans.

From www.addressofchoice.com

Here's What People Are Saying About How To Pay Property Tax Online Do You Pay Property Tax On Va Loans Due to the variances in property taxes from location to location, it's important to send. Lenders may require downpayments for some borrowers using the va home loan guaranty, but va does not. Tax deductions for va home loans. The disabled veterans property tax exemption can help reduce the amount a disabled veteran pays per year in taxes. Some states may. Do You Pay Property Tax On Va Loans.

From sinkforce15.bitbucket.io

How To Avoid Paying Property Tax Sinkforce15 Do You Pay Property Tax On Va Loans There are a few different tax deductions that va borrowers can take advantage of. Due to the variances in property taxes from location to location, it's important to send. Some states may only give exemptions to veterans who are 100% permanently disabled. Lenders may require downpayments for some borrowers using the va home loan guaranty, but va does not. Property. Do You Pay Property Tax On Va Loans.

From carduphelp.zendesk.com

How do you pay property tax on CardUp? CardUp Help Center Do You Pay Property Tax On Va Loans Property taxes can vary greatly by state, county or region. There are a few different tax deductions that va borrowers can take advantage of. Some states may only give exemptions to veterans who are 100% permanently disabled. Lenders may require downpayments for some borrowers using the va home loan guaranty, but va does not. The disabled veterans property tax exemption. Do You Pay Property Tax On Va Loans.

From www.pinterest.com

Everything You Need to Know About VA Home Loans for Military Veterans Do You Pay Property Tax On Va Loans The disabled veterans property tax exemption can help reduce the amount a disabled veteran pays per year in taxes. Property taxes can vary greatly by state, county or region. There are a few different tax deductions that va borrowers can take advantage of. Some states may only give exemptions to veterans who are 100% permanently disabled. Due to the variances. Do You Pay Property Tax On Va Loans.

From nationwidemortgageandrealty.net

VA Property Tax Exemptions by State VA Loan Benefits Do You Pay Property Tax On Va Loans There are a few different tax deductions that va borrowers can take advantage of. Some states may only give exemptions to veterans who are 100% permanently disabled. Property tax exemptions for veterans. The disabled veterans property tax exemption can help reduce the amount a disabled veteran pays per year in taxes. Lenders may require downpayments for some borrowers using the. Do You Pay Property Tax On Va Loans.

From www.kshb.com

What it means to pay property taxes under protest Do You Pay Property Tax On Va Loans Property taxes can vary greatly by state, county or region. There are a few different tax deductions that va borrowers can take advantage of. Tax deductions for va home loans. Lenders may require downpayments for some borrowers using the va home loan guaranty, but va does not. If property taxes are unpaid the local government can foreclose the property —. Do You Pay Property Tax On Va Loans.

From usahousinginformation.com

Do You Have to Pay Property Taxes Forever? Let's Find out! [2023] Do You Pay Property Tax On Va Loans If property taxes are unpaid the local government can foreclose the property — even if the monthly. The disabled veterans property tax exemption can help reduce the amount a disabled veteran pays per year in taxes. There are a few different tax deductions that va borrowers can take advantage of. Tax deductions for va home loans. Due to the variances. Do You Pay Property Tax On Va Loans.

From www.stackedlife.com

A Better Way to Pay Property Tax Do You Pay Property Tax On Va Loans Lenders may require downpayments for some borrowers using the va home loan guaranty, but va does not. Some states may only give exemptions to veterans who are 100% permanently disabled. Due to the variances in property taxes from location to location, it's important to send. The disabled veterans property tax exemption can help reduce the amount a disabled veteran pays. Do You Pay Property Tax On Va Loans.

From va-kreeg.blogspot.com

√ Does Veterans Pay Property Taxes Va Kreeg Do You Pay Property Tax On Va Loans If property taxes are unpaid the local government can foreclose the property — even if the monthly. Lenders may require downpayments for some borrowers using the va home loan guaranty, but va does not. There are a few different tax deductions that va borrowers can take advantage of. The disabled veterans property tax exemption can help reduce the amount a. Do You Pay Property Tax On Va Loans.

From www.youtube.com

Should you pay property taxes through your mortgage lender ? YouTube Do You Pay Property Tax On Va Loans Some states may only give exemptions to veterans who are 100% permanently disabled. Lenders may require downpayments for some borrowers using the va home loan guaranty, but va does not. If property taxes are unpaid the local government can foreclose the property — even if the monthly. Property tax exemptions for veterans. The disabled veterans property tax exemption can help. Do You Pay Property Tax On Va Loans.

From www.hechtgroup.com

Hecht Group Do Va Loans Pay Property Taxes Do You Pay Property Tax On Va Loans Property tax exemptions for veterans. Some states may only give exemptions to veterans who are 100% permanently disabled. Lenders may require downpayments for some borrowers using the va home loan guaranty, but va does not. Due to the variances in property taxes from location to location, it's important to send. There are a few different tax deductions that va borrowers. Do You Pay Property Tax On Va Loans.

From www.fool.com

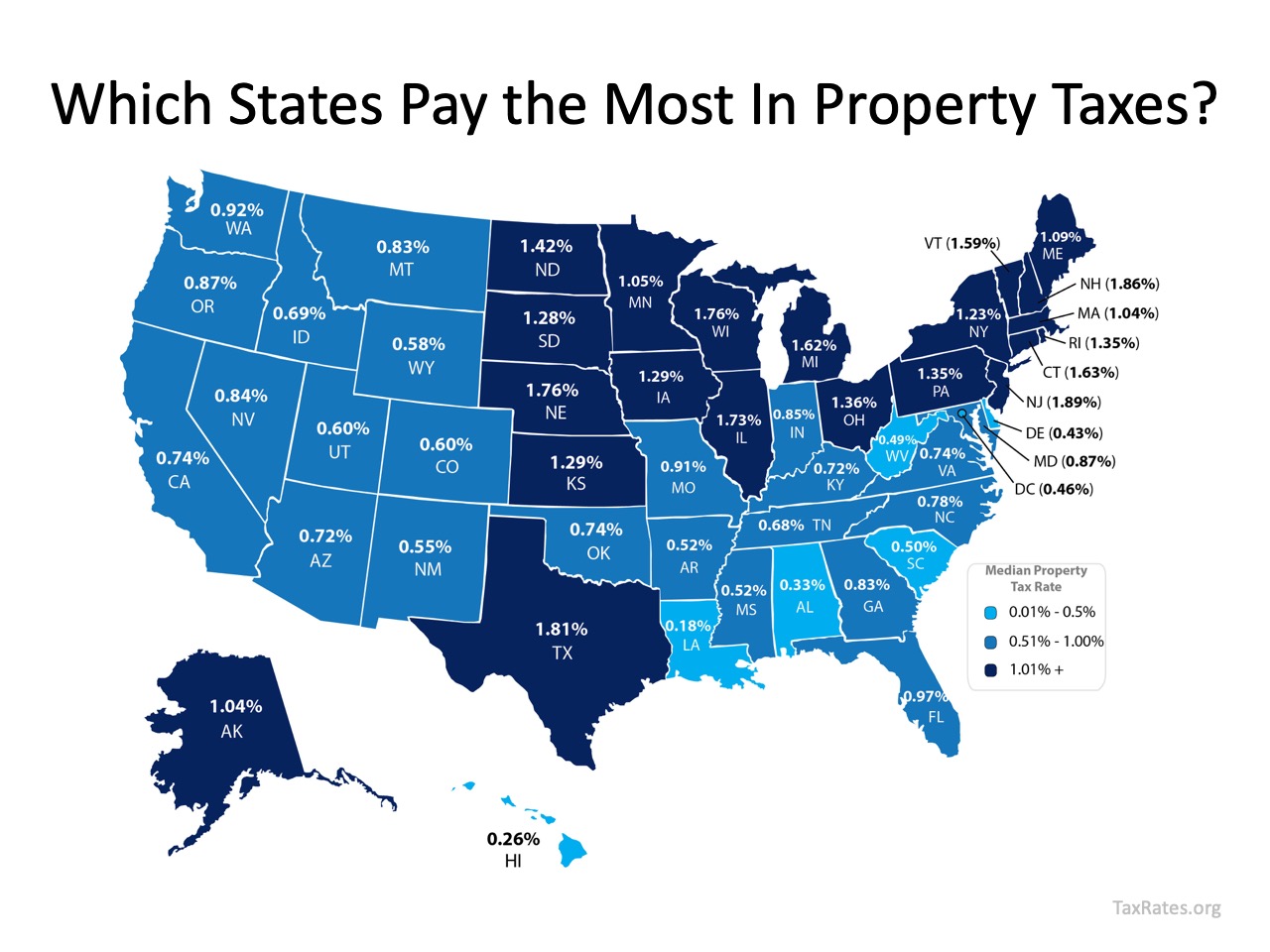

Property Tax Rates by State Millionacres Do You Pay Property Tax On Va Loans Due to the variances in property taxes from location to location, it's important to send. Property tax exemptions for veterans. If property taxes are unpaid the local government can foreclose the property — even if the monthly. Tax deductions for va home loans. The disabled veterans property tax exemption can help reduce the amount a disabled veteran pays per year. Do You Pay Property Tax On Va Loans.

From www.buyhomesincharleston.com

How Property Taxes Can Impact Your Mortgage Payment Do You Pay Property Tax On Va Loans If property taxes are unpaid the local government can foreclose the property — even if the monthly. Some states may only give exemptions to veterans who are 100% permanently disabled. Tax deductions for va home loans. Property taxes can vary greatly by state, county or region. There are a few different tax deductions that va borrowers can take advantage of.. Do You Pay Property Tax On Va Loans.

From va-kreeg.blogspot.com

√ Does Veterans Pay Property Taxes Va Kreeg Do You Pay Property Tax On Va Loans There are a few different tax deductions that va borrowers can take advantage of. Due to the variances in property taxes from location to location, it's important to send. Tax deductions for va home loans. Lenders may require downpayments for some borrowers using the va home loan guaranty, but va does not. Property tax exemptions for veterans. Some states may. Do You Pay Property Tax On Va Loans.

From www.news5cleveland.com

Disabled veterans in Ohio would get tax break under proposed bill Do You Pay Property Tax On Va Loans There are a few different tax deductions that va borrowers can take advantage of. If property taxes are unpaid the local government can foreclose the property — even if the monthly. Due to the variances in property taxes from location to location, it's important to send. Lenders may require downpayments for some borrowers using the va home loan guaranty, but. Do You Pay Property Tax On Va Loans.

From www.hegwoodgroup.com

How To Understand Your Property Tax Assessment Tips From The Pros Do You Pay Property Tax On Va Loans Property taxes can vary greatly by state, county or region. There are a few different tax deductions that va borrowers can take advantage of. Some states may only give exemptions to veterans who are 100% permanently disabled. The disabled veterans property tax exemption can help reduce the amount a disabled veteran pays per year in taxes. If property taxes are. Do You Pay Property Tax On Va Loans.

From www.clevergirlfinance.com

How Often Do You Pay Property Tax? Your Questions Answered Do You Pay Property Tax On Va Loans Property tax exemptions for veterans. The disabled veterans property tax exemption can help reduce the amount a disabled veteran pays per year in taxes. If property taxes are unpaid the local government can foreclose the property — even if the monthly. There are a few different tax deductions that va borrowers can take advantage of. Property taxes can vary greatly. Do You Pay Property Tax On Va Loans.